Remote Intelligent Order Placement

Fintech

Democratizing Global Trading

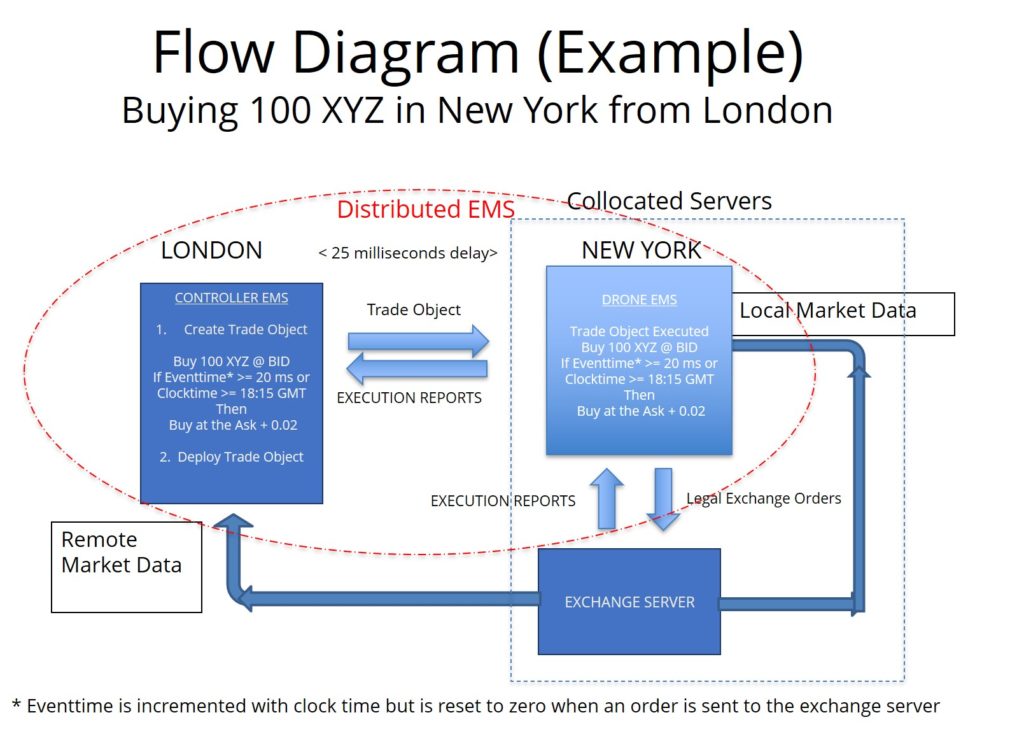

RIOP allows one DMA (Direct Market Access) at a distance by mitigating latency effects. It does this by creating a ‘trading object’ which is the embodiment of the what and the how of the trade. It combines data and the method into an object to be deployed at a distant server collocated to an exchange via a simple English like protocol all on the fly.

The trader can thus communicate the full robustness of his intent to the exchange venue; the EMS (Controller) is virtually cloned (Drone) at the exchange. It is a distributive EMS!! It allows refactoring, integration, modularity, and scalability resulting in better execution (lower cost, better timing), and more profitability (cutting costs, allowing for new revenue schema).

Advantages

A robust set of scripting snippets allows the users a broad range of implementation strategies

Use the customer’s own methodologies

Able to use knowledge of total order to advantage

Keeps information leakage to a minimal since most information is held close to the vest

Execution strategies can be changed on the fly per each order sent out